Spy investment calculator

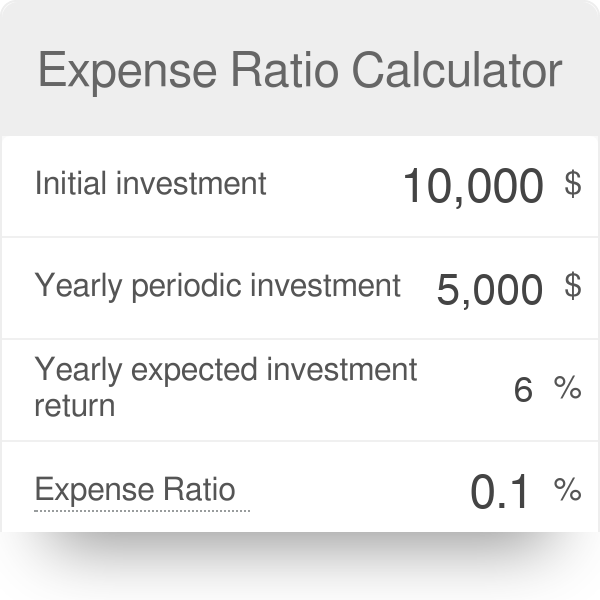

Enter an initial investment. And by using our Expense Ratio.

Password Vault Sharper Image Password Vault Sharper Image Diy Gifts For Mom

Yearly expected investment return 1359.

. Expense Ratio SPY 00945. If you have say 1000 to invest right now include that amount here. The Probability Calculator evaluates option prices to compute the theoretical probability of future stock prices.

An SP 500 calculator is used to analyze data to calculate the total return annualized return and a summary of profit and loss. Axos Banks evolved banking model offers incredible returns at a low cost to you our customer. Learn How We Can Help.

Our investment calculator tool shows how much the money you invest will grow over time. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. Ad Meeting Your Long-Term Investment Goals Is Dependent On A Number Of Factors.

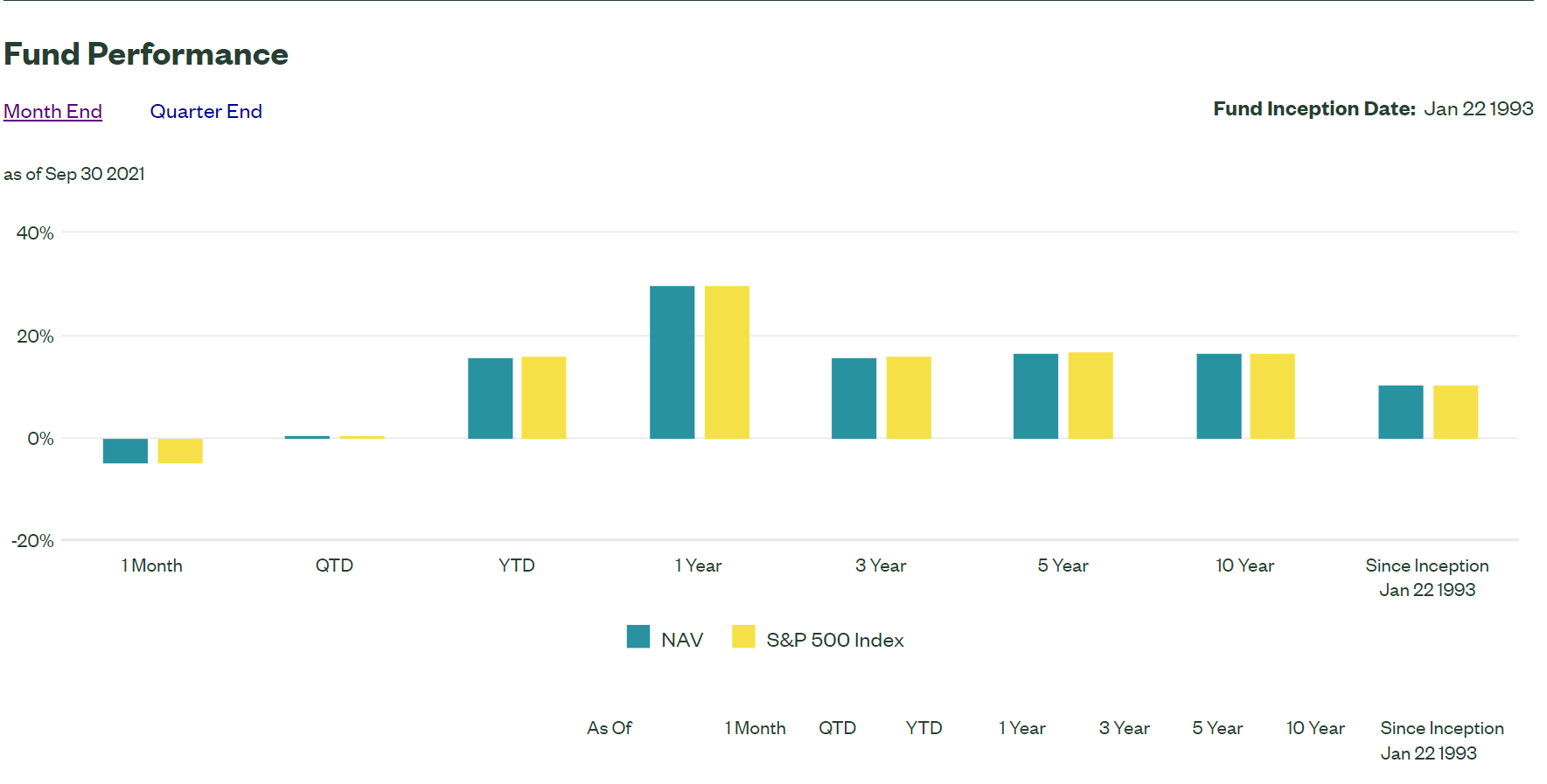

Now we are going to do the same calculation but with the SPY ETF information. To better personalize the results you can make additional. InvestSpy provides you with free access to.

Below is a SP 500 return calculator with dividend reinvestment a feature too often skipped when quoting investment returnsIt has Consumer Price Index CPI data. Making consistent investments over a number of years can be an effective strategy to accumulate wealth. We use a fixed rate of return.

Understand The Potential Returns You Might Receive From Investments. View the current SPY stock price chart historical data SPDR SP 500 reports and more. Never settle for meager interest yields.

Get detailed information about the SPDR SP 500 ETF. One of the simplest yet incredibly helpful calculators is. Ad A Financial Advisor in Biddeford ME.

Even small additions to your investment add up over. The Texas Instruments BA II Plus Financial Calculator is a great all-around financial calculator which is suitable for statisticians managers and students. This stock option calculator computes can compute up to eight contracts and one stock position which allows you to pretty much chart most of the stock options strategies.

Quantalytics is not a registered investment adviser brokerage firm or investment company. Free Stock Options Probability Calculator. How to use NerdWallets investment return calculator.

Data may be loaded. The SPDR SP 500 ETF Trust also known as the SPY ETF is one of the most popular funds that aims to track the Standard Poors 500 Index which comprises 500 large. Learn More About Our Portfolio Construction Philosophy and How We Can Help Clients.

Smarter savings means more money to reach your. Ad Objective-Based Portfolio Construction is Key in Uncertain Times. Discover the Power of thinkorswim Today.

Risk contributions volatility beta value at risk VaR and maximum drawdown estimates help you understand your existing.

Historical Investment Calculator Financial Calculators Com

Spdr S P 500 Trust Spy One Of The Best Etfs For Passive Investing Seeking Alpha

Spdr S P 500 Trust Spy One Of The Best Etfs For Passive Investing Seeking Alpha

Pin On Picspam Inspiration

Historical Investment Calculator Financial Calculators Com

3 Reasons Nio Is My Top Ev Pick Nyse Nio Seeking Alpha Amortization Schedule Household Insurance Mortgage Calculator

Expense Ratio Calculator For Etfs

Hebrew For Dummies Cheat Sheet Dummies French For Dummies Useful French Phrases Investing

Interactive Brokers View Interactive Brokers Investing Positivity

A Matching Numerical Keypad For Your Wireless Apple Keyboard Apple Keyboard Keyboard Imac

Investing Newbie J P Morgan Asset Management

Dollar Cost Average Investment Strategy Vs Lump Sum Investment Strategy Using Python Youtube

Discover Why The Gold Rate In Usa Is Skyrocketing Bitcoin Cryptocurrency Buy Bitcoin

Stock Total Return And Dividend Calculator

Bear Market Rally Or Start Of A New Bull What To Look For Investing Investing Money Best Investments

Tail Risk Funds Tend To Be Most In Demand When They Are Least Attractive Fund Hedge Fund Manager Value Stocks

How To Invest In The S P 500 Money